VAT Voluntary Disclosure UAE

FTA VAT Voluntary Disclosure UAE

How to correct VAT errors by FTA VAT voluntary disclosure UAE is a very complicated question. It will be a disaster if a business makes an error or mistake while submitting VAT and then make another error while submitting a VAT voluntary disclosure.

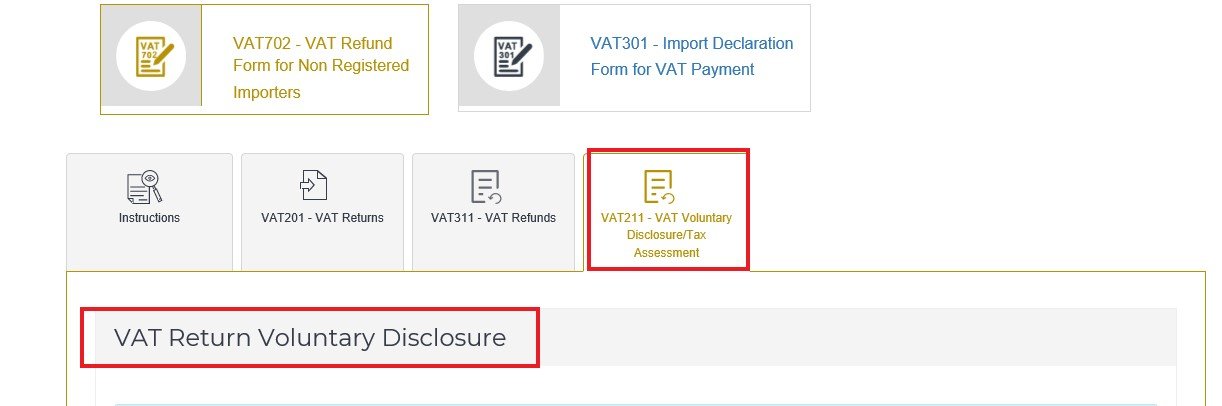

FTA VAT Voluntary Disclosure UAE is a form provided by the Federal Tax Authority (FTA) according to which the Taxpayer notifies the FTA of an error or omission in a Tax Return, Tax Assessment, or Tax Refund application. VAT voluntary disclosure form is commonly known as VAT211.

How to correct VAT errors by FTA VAT Voluntary Disclosure UAE

The basic purpose of the VAT voluntary disclosure form is to allow the taxable persons or businesses to voluntarily disclose the mistakes or error they have committed in the previous VAT returns or VAT refunds, by making a correction or omission.

Businesses can use the VAT voluntary disclosure – form 211 to inform the Federal Tax Authority (FTA) about the mistakes they have done while submitting a VAT return or applying for the VAT refund. It will allow the taxable businesses to rectify the mistakes or errors voluntarily before the authority finds it before a VAT audit or through an assessment.

When you should submit a VAT Voluntary Disclosure Form?

There would be specific scenarios where a VAT Voluntary Disclosure Form should or can be used by taxpayers and submitted to the FTA. This would, in general, be in cases where a taxpayer becomes aware of an error or omission in a VAT Return, VAT Assessment or VAT Refund application, as below:

If you become aware that a VAT return submitted by you to the FTA or a VAT Assessment sent to you by the FTA is incorrect, which resulted in a calculation of the Payable Tax being less than it should have been, you must submit a VAT Voluntary Disclosure to correct such error.

If you become aware that a VAT return submitted by you to the FTA or a VAT Assessment sent to you by the FTA is incorrect, which resulted in a calculation of the Payable Tax being more than it should have been, you may submit a VAT Voluntary Disclosure to correct such error.

If you become aware that a VAT refund application submitted by you to the FTA is incorrect, which resulted in calculating the refund amount to which you are entitled being more than it should have been, you must submit a Voluntary Disclosure to correct such error.

When you should NOT submit a VAT Voluntary Disclosure?

Businesses are not required to submit a Voluntary Disclosure for the underpaid tax if the amount of the Payable Tax is not more than AED 10,000 as long as the person is able to correct the error in the Tax Return for the tax period in which the error has been discovered.

Time frame for submitting a VAT Voluntary Disclosure

The voluntary disclosure must be made within 20 business days of discovering the error or penalties may apply.

All the taxable businesses must submit their VAT returns correctly and accurately within the time frame specified by the FTA.

Companies must ensure that the VAT Return Filing has been submitted as per the FTA laws, it will minimize the frequency of using the VAT Voluntary Disclosure Form 211 to avoid VAT fines and penalties.

Xact Auditing will assist you in submitting VAT voluntary disclosure to FTA. VAT Voluntary Disclosure form requires a very keen consideration and there are many factors which should be followed as per the FTA law and it may well be worth-while obtaining professional advice of a registered tax consultants prior to making any Voluntary Disclosures, so that the potential flow on consequences can be considered and addressed. If you have made any error while handling your VAT, don’t panic and let Xact handle your VAT voluntary disclosure, Contact us!

Xact Services

Previous Post

Previous Post Next Post

Next Post

By mistake we clicked on submit voluntary form what to do

Hi,

You do not have to do anything. It is alright.

Thank you