What is Reverse Charge Mechanism (RCM) under VAT?

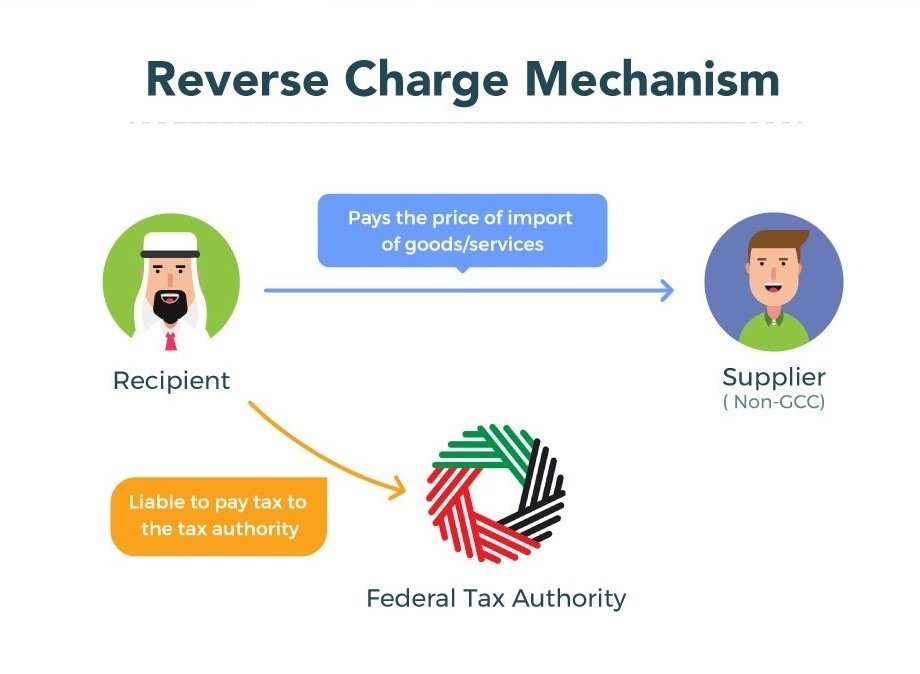

Reverse Charge Mechanism under VAT is applicable while importing goods or services from outside the GCC countries. In VAT reverse charge, end customer pays VAT directly to FTA. In VAT reverse charge mechanism, the responsibility of paying VAT to the FTA shifts from supplier to buyer or customer.

In a common business transaction, the supplier supplies goods or services to the customer and collects VAT on behalf of the customer and later pay it to the FTA. Under reverse charge mechanism (RCM), the supplier does not charge VAT to the customer and the customer or end user pays the VAT directly to the FTA.

What is VAT Reverse Charge Mechanism?

While importing goods or services from outside the GCC countries, reverse charge mechanism will apply. Businesses will not pay VAT at the time of import. The responsibility of reporting VAT shifts from supplier to customer under VAT reverse charge mechanism. The buyer will report both input VAT and output VAT in their VAT return.

The supplier does not have to pay VAT on import items, so the obligation of reporting a VAT transaction is shifted from the seller to the recipient. The recipient will have to record the VAT on purchases (input VAT) and the VAT on sales (output VAT) in their VAT return each quarter.

VAT reverse charge mechanism abolish the responsibility for the businesses outside the UAE to register for VAT.

When is VAT RCM applicable?

While doing a business transaction with the business which are not physically present in UAE and the business or supplier is providing goods or services from outside the country, the VAT does not apply on the businesses who are not in UAE. So the recipient who has business in UAE and receiving goods from the supplier from outside UAE are made to pay VAT on reverse charge basis. Businesses will apply VAT reverse charge on following scenarios:

Supply of diamonds and gold

Purchase of diamonds and gold for resale or production or manufacture

Import of goods or services from GCC or non GCC countries. The supplier must be located in another country and they may or may not have a business in the UAE

Purchase of goods from designated zone

Supply of hydrocarbons for resale by a registered supplier to a registered recipient in the UAE

Supply of crude/refined oil by a registered supplier to a registered recipient in the UAE

Supply of processed/unprocessed natural gas by a registered supplier to a registered recipient in the UAE

Production and distribution of any form of energy supplied by a registered supplier to a registered recipient in the UAE

Understanding of Reverse Charge under VAT

Let’s take an example to understand the concept of VAT RCM more clearly and simply.

Company 1 – ABC General Trading – VAT registered Company in UAE

Company 2 – XYZ Traders – Registered Company in USA

ABC company which is in UAE is importing goods from XYZ company which is in USA. XYZ company is not registered in UAE and does not have to pay VAT or get register under the FTA as they do not have business in UAE. As ABC company in UAE is importing goods from the company which is outside from UAE, so ABC company will apply reverse charge mechanism on his relevant VAT return.

In RCM VAT, the responsibility to pay VAT shifts from the supplier to the customer. Businesses must be careful while handling the reverse charge cases and must keep all the supportive documents such as invoices for the reference.

What are the requirements for Reverse Charge?

- Receiver of the goods and services must be registered under VAT

- All the registered businesses in UAE must keep all the records of their supplies the incur reverse charge

- Receipt vouchers, payment vouchers and invoices must specify that the payable tax of that transaction is through reverse charge.

VAT reverse charge mechanism is a complicated concept and it must be dealt with high experience and attention. Our professional tax experts will help you understand the concept of VAT reverse charge mechanism and assist you in all kinds of VAT services in order to avoid unnecessary VAT fines from FTA. Xact Auditing is also providing audit services, accounting services, liquidation services and covering all the aspects of VAT services in Dubai.

Xact Services

Previous Post

Previous Post Next Post

Next Post

Thank you!