VAT on E-commerce Sales in UAE

VAT on Online Sales

VAT on E-commerce sales in UAE depends on the location of supplier and recipient. 5% VAT will be applicable on online sales in UAE.

A supply of goods in the e-commerce context involves purchasing goods through an electronic platform, such as a website or a marketplace. Once the goods are purchased, they are then delivered to the recipient.

Depending on the location of the supplier, the recipient, and the goods, the supply may take any of the following basic forms:

• A supply by a resident supplier to a recipient in the UAE, with goods being delivered from either inside or outside the UAE;

• A supply by a resident supplier to a recipient outside the UAE, with goods being delivered from either inside or outside the UAE;

• A supply by a non-resident supplier to a recipient in the UAE, with goods being delivered from either inside or outside the UAE; and

• A supply by a non-resident supplier to a recipient outside the UAE, with goods being delivered from either inside or outside the UAE.

In each of the above scenarios, the supplier has to consider the impact of VAT on the sale of the goods. In addition, where the goods are physically imported into the UAE from outside the UAE.

Impact of VAT on E-commerce Business

The Federal Tax Authority (FTA) has confirmed that all purchases made through online shopping portals are subject to the same 5% Value Added Tax (VAT) as any other purchase made through traditional outlets if the products purchased online are received within the United Arab Emirates.

As per the Article (18) of Decree Law, a non-resident shall register for tax and makes supplies of goods or services, there is no threshold limit applicable to the non-residents. “This means if a consumer in the UAE buys a service/product from an online platform (social media, e-commerce, education, games, arts, fashion, music or any other services), the non-resident shall register for the VAT within the stipulated time and comply with local tax legislation.

VAT on E-commerce Sales

Physical goods and electronic services such as software, e-games, e-subscriptions, mobile phone applications and e-content are subject to specific rules that regulate how VAT applies to them.

(a) Sales & purchase of goods or services through e-commerce within UAE is considered as domestic sales and are subject to standard 5 per cent VAT rate.

(b) Purchase of goods or services from outside UAE, is subject to standard 5 per cent VAT rate.

(i) If recipient of goods or services is in UAE and registered for VAT (as a taxable person), then in this case recipient of goods or services is expected to calculate the standard 5 per cent VAT using reverse charge mechanism, whereby the taxable recipient calculates the due VAT instead of the non-resident supplier.

(ii) If the recipient is the end consumer (i.e. not registered with tax authority for VAT), then standard 5 per cent VAT is charged and paid to the authority by the agent or logistic company. Agent (who supplies/imports) will be responsible for compliance of UAE VAT for all imports on behalf of not registered individual.

VAT and E-commerce

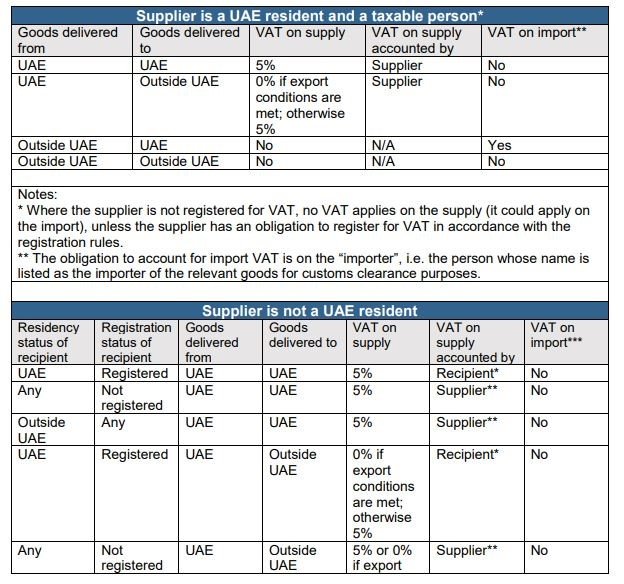

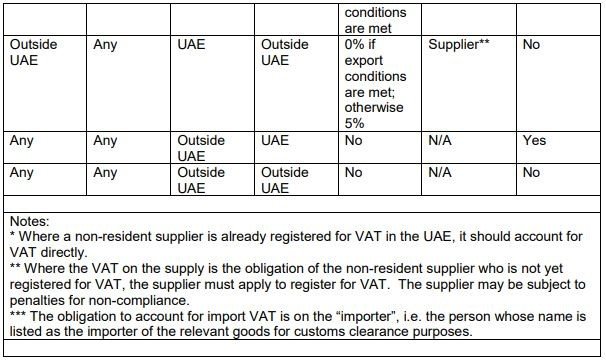

The table below summarises the VAT treatment of various scenarios involving supplies of goods by a supplier who is resident in the UAE and a supplier who is not resident in the UAE.

For the purposes of this table, it has been assumed that the supply takes place before or at the time the goods are dispatched, that is, in the location from which the goods are delivered.

VAT treatment of electronic services

“Electronic services” mean services which are automatically delivered over the internet, an electronic network, or an electronic marketplace. The place of supply of electronic services determines whether or not the services are subject to VAT in the UAE. Where the place of supply is outside the UAE, no UAE VAT would apply. In contrast, where the place of supply is in the UAE, the supply will fall within the UAE VAT net.

The default VAT rate on a taxable supply of services in the UAE is 5%. The supply may, however, be zero-rated if it falls under any of the zero-rating scenarios in Article 45 of the Decree-Law. For example, a supply of an electronic service of distance learning which is automatically delivered over the internet may be zero-rated if it is covered by Article 45(13) of the Decree-Law, read with Article 40 of the Executive Regulation.

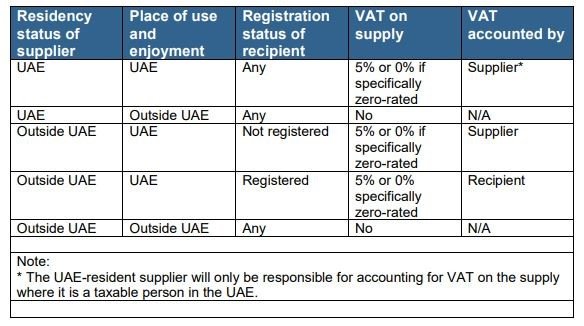

The table below summarises the high-level indicative VAT treatment of various scenarios related to supplies of electronic services.

VAT Registration for Amazon Sellers

VAT registration for Amazon sellers in UAE is mandatory by the Federal Tax Authority (FTA). Amazon sellers must register for VAT before start making sales in UAE. More and more businesses are moving towards digital platforms and start selling their business on e-commerce platforms. As per FTA laws, businesses in UAE selling through online channels must charge the standard rate of VAT which is 5%.

VAT Services in UAE

Xact Auditing is covering all the aspects of VAT services in UAE. For FTA compliant VAT services in Dubai, Contact us. We have professional and experienced tax specialists who can handle all kinds of complex issues related to VAT. We handle VAT with extreme attention in order to follow the rules and regulations of Federal Tax Authority (FTA).

Xact Services

Previous Post

Previous Post Next Post

Next Post