Tax Residency Certificate (TRC) UAE

What is Tax Residency Certificate (TRC)?

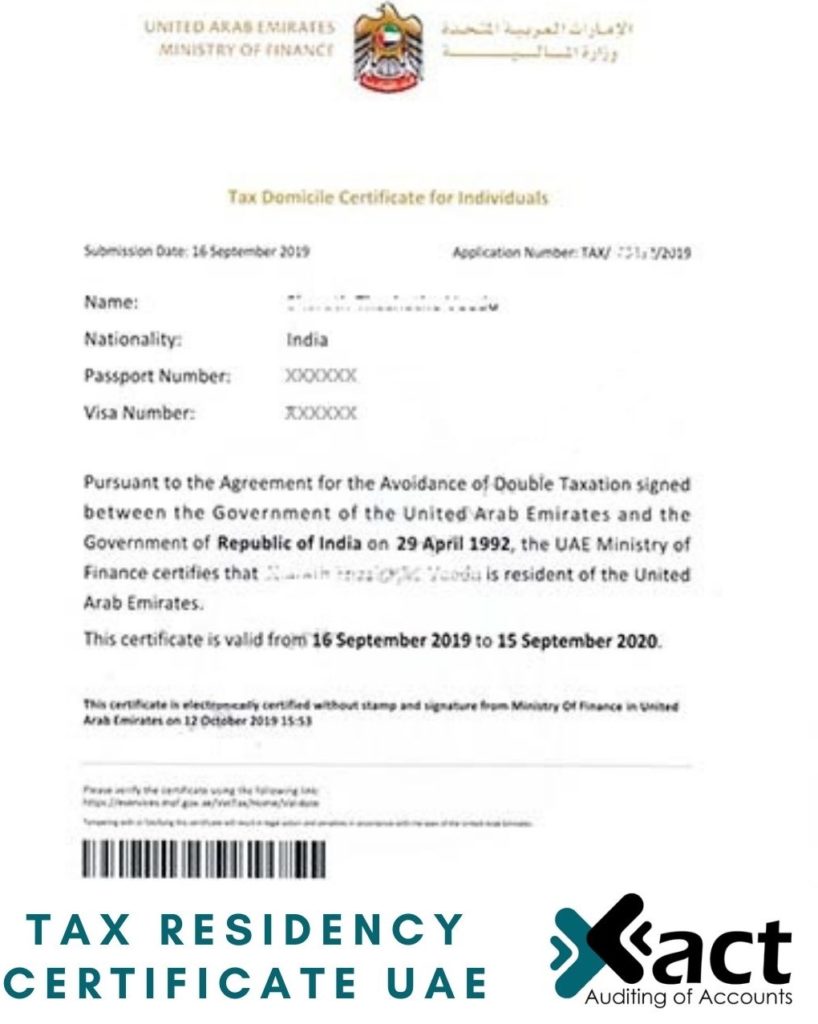

Tax Residency Certificate TRC UAE is also called as Tax Domicile Certificate to take advantage of double taxation avoidance agreements signed by UAE. A certificate issued for eligible natural and legal persons to benefit from Double Tax Avoidance Agreements (DTAA) on income signed by the UAE.

What are Commercial Activities Certificate?

A certificate issued for a business person to refund VAT paid outside the UAE, whether or not DTAAs are applicable.

Starting from 14th of November - FTA launches Digital Tax Certificate Services

How to Obtain Tax Residency Certificate (TRC) in UAE?

Tax Residency Certificate in UAE or sometimes called a Tax Domicile Certificate is an official certificate or document which is issued by the Ministry of Finance of UAE to either Company inside UAE for at least 1 year of age or an Individual with a UAE residency visa / permanently residing in the UAE for at least minimum of 180 Days.

This Official Certificate is used to fully utilize the advantages of the extensive double tax treaties and to take advantage of double taxation avoidance agreements signed by the UAE with over 76 Countries in the World and this certificate valid for one year from the date of its issue.

This Official Tax Residency Certificate is not Applicable to Offshore Companies (International Business Companies).

The Required Documents for Tax Residency Certificate will depend on the type of Applications:

What is the purpose of Tax Residency Certificate?

- TRC for Domestic Tax Purposes

- TRC for Treaty Tax Purposes

REQUIRED DOCUMENTS FOR TAX RESIDENCY CERTIFICATE (COMPANIES):

- Valid Company Trade License Copy

- Memorandum of Assocation (MOA)

- Manager Passport Copy

- Manager Residence Visa

- Manager Emirates ID

- Financial Audit Report (Should be relevant to the year you are applying to)

- 6-months Company bank statement

- Copy of lease agreement or Tenancy Contract under the name of the company

REQUIRED DOCUMENTS FOR TAX RESIDENCY CERTIFICATE (INDIVIDUALS):

- Passport Copy

- UAE Residence Visa Copy

- Emirates ID Copy

- A copy of (residential) lease agreement or Tenancy Contract Copy (Ejari or Title Deed)

- Latest Salary certificate or any Proof of income in UAE.

- Latest 6-months bank statement

- Entry and exit report from Federal Authority of Identity and Citizenship or a local competent Government entity. (must be at least 183 days)

- Tax forms (if any) from the country in which the certificate is to be submitted.

TIME SPAN

3-5 working days for Pre-approval processing.

4-7 working days for the issuance of the Tax Residency Certificate once it is approved.

Terms and Conditions for TRC

TRC UAE Cost

- AED 50 for TRC application submission.

- AED 500 for all tax registrants (Individuals and Companies)

- AED 1,000 for non-tax registrant natural persons (Individuals)

- AED 1,750 for non-tax registrant legal persons (Companies)

- AED 250 for printed TRC

How to apply for TRC in UAE?

To obtain a tax residency certificate, an online process needs to be followed by the applicant. The steps include:

- Create an online account in the Ministry of Finance (MoF) portal;

- Fill out the application to obtain UAE Tax Residence Certificate;

- Once the application is approved, payment needs to be done online.

Xact Auditing will assist you in obtaining a tax residency certificate in UAE. Xact Auditing is one of the most professional and approved audit and accounting firm in Dubai.

Tax Residency Certificate UAE Validity

A Tax Residency Certificate (TRC) is valid for 1 year from the starting date of the financial year.

Lost, Damaged, or Copy of Original

– Pay 100 Dirhams for issuing a replacement of lost, damaged or copy of original certificate + 3 Dirhams, paid through e-Dirham Card

Xact Services

Dear Sirs,

can I receive a TRC if I have a Golden Visa and a own house /utility bills, a bank account and been only 3 Monts in Dubai per year?

Yes, being a Golden visa holder you can apply for the tax residency certificate (TRC) in UAE.

One of our representatives will get in touch with you via email.

I had stayed in UAE (employment) from 2014 to 2021. Now residing in Kuwait. How do I get tax residency certificate from UAE now. I needed for replying to tax query in India. Appreciate your help.

Thank you for your inquiry regarding tax residency certificate for individual in UAE. One our agents will contact you via email.

I want to get TRC for individual in uae

Hello Kathan,

Thank you for your inquiry regarding TRC for individuals in UAE. We have sent you a detailed email regarding the documents required for tax residency certificate along with timeline and pricing.

Thank you.