Tax Residency Certificate for Domestic Tax Purposes

What is Tax Residency Certificate for Domestic Tax Purposes?

A Tax Residency Certificate for domestic tax purposes in the UAE is essential for confirming an individual or company’s tax status and obligations within the country. The Federal Tax Authority (FTA) issues these certificates to individuals and business to establish tax residency in line with local tax regulations and benefits.

Who can apply for the Domestic Tax Residency Certificate?

- Individuals: Must be UAE residents who have lived in the country for at least 183 days during a given tax year. Non-residents or tourists cannot apply for a TRC.

- Companies: Must be established and registered in the UAE for at least a year and have active business operations. Free zone companies and mainland companies are eligible, but offshore companies and the branch companies are generally not eligible for a TRC.

What is the purpose of Tax Residency Certificate?

- TRC for Domestic Tax Purposes

- TRC for Treaty Tax Purposes

Domestic TRC for Individuals

Individuals with residency status in the UAE who earn income from other countries may also benefit from the TRC to show UAE tax residency. Although the UAE has no personal income tax, the certificate can be valuable if a foreign country requires proof of residency to prevent double taxation on income or assets held abroad.

A natural person or an individual will be considered a Tax Resident in the UAE for domestic tax purposes if they meet at least one of the three conditions:

- they are a UAE or Gulf Cooperation Council (GCC) national, or hold a valid UAE Resident Permit, and

- they have a Permanent Place of Residence in the UAE, or carry on an employment or Business in the UAE.

Domestic TRC for Companies

A juridical person or a companies operating in the UAE for over one year are considered to be a Tax Resident of the UAE if it is:

1. Incorporated or otherwise formed or recognized in the UAE

2. Companies such as Limited Liability Company, Private Shareholding Company, Public and Private Joint Stock Company,

3. Civil companies

4. Foundations

5. Free Zone companies in the UAE

Documents Required for Domestic TRC [Individuals]

Applicant is a natural person spent in the UAE above 183 days:

- Passport (mandatory) and Emirates ID/ UAE Visa residence if available.

- Entry and exit report from Federal Authority of Identity and Citizenship or a local competent Government entity.

Applicant is a natural person spent in the UAE less than 183, and equal or more than 90 days:

- Passport (mandatory) and Emirates ID/ UAE Visa residence if available.

- Entry and exit report from Federal Authority of Identity and Citizenship or a local competent Government entity.

- Source of income/salary certificate/ Other proof of carrying on a business in the UAE. Or Proof of permanent place of residence: Title deed, EJARI, Utility Bills or Other long-term Rent Contract.

Applicant is natural person spent in the UAE less than 90 days or other situations:

- Passport (mandatory) / EID

- Entry and exit report from Federal Authority of Identity and Citizenship

- Proof of Financial and Personal Interests (The place of the natural person’s occupation, familial and social relations, cultural or other activities, place of business, place from which the property of the natural person is administered and any other relevant facts and circumstances should be considered in the determination of whether a natural person’s centre of financial and personal interests is in the State).

- Proof of permanent place of residence: Title deed, EJARI, Utility Bills or Other long-term Rent Contract.

Documents Required for Domestic TRC [Companies]

- Trade License

- Memorandum of Association (MOA)

- Bank statement for the last 6 months

- Audited Financials Statements

- VAT Registration Certificate (TRN)

Validity of a TRC

- The TRC is valid for one year from the date of issuance.

- A TRC for domestic purposes cannot be issued for any part of a future period.

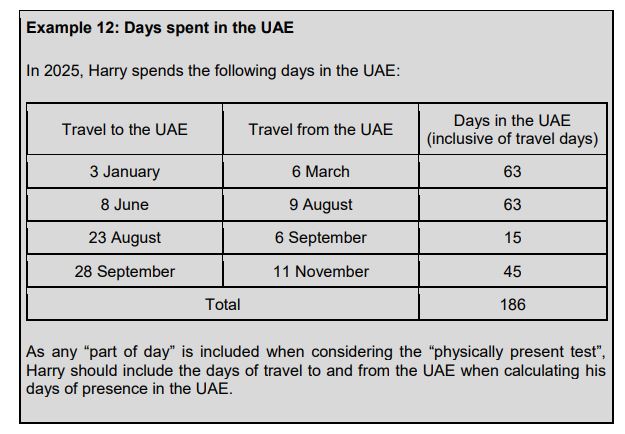

How to measure days spent in the UAE for TRC?

Every day, or part of a day, that an individual spends physically present in the UAE will be counted as a UAE day. These days do not need to be consecutive when calculating the 183-day or 90-day period.

Fees for TRC in UAE

Each TRC application requires a submission fee of AED 50, plus an additional fee as follows:

- AED 500 for tax registrants – Companies

- AED 1,000 for non tax registrants – Individuals

Duration of Domestic TRC application

- Tax Residency Certificate

5 business days from the date the completed application was received. - In case the applicant requested hard copy of the certificate

5 business days from the date the certificate fees payment is completed. - In case the applicant has a tax, form requires FTA attestation

5 working days from the date the completed form is received and fees of the certificate has been paid.

TRC Services in UAE

If you are looking to obtain a Tax Residency Certificate (TRC) in UAE, we offer professional guidance and support to streamline the TRC application process. Our team is highly knowledgeable in the requirements and procedures, assisting both individuals and businesses in securing their TRC efficiently while ensuring full compliance with UAE regulations. For all kinds of TRC, contact us.

Previous Post

Previous Post