How to file VAT Return in UAE?

You must file for VAT return electronically through the FTA portal. Before filing the VAT return form, make sure you have met all tax returns requirements. At the end of each tax period, VAT registered businesses or the ‘taxable persons’ must submit a ‘VAT return’ to Federal Tax Authority (FTA).

Businesses are required to manually provide the values of Sales, Purchase, Input VAT, Output VAT etc. in the appropriate boxes of the VAT return form available on FTA portal.

VAT Return Form

The VAT Return form is named as ‘VAT 201‘ which the taxpayer needs to fill and submit in order to complete the VAT Return filing. The Form VAT 201 is broadly categorized into 7 sections as mentioned below:

- Taxable Person Details

- VAT Return Period

- VAT on sales and all other outputs

- VAT on expenses and all other inputs

- Net VAT Due

- Additional reporting requirements

- Declaration and Authorized Signatory

Procedure of VAT Return Filing in UAE

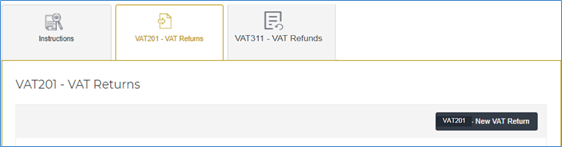

- VAT Return Form 201

Taxpayer must log in to their FTA e-Services portal using their registered username and password in order to access the VAT Return Form 201. From the form Navigation menu, select the ‘VAT’->VAT 201- VAT Return-> click on ‘VAT 201-New VAT Return’ to initiate the VAT return filing process.

After that, click on ‘VAT 201- New VAT Return’ as shown in the above image, New VAT return form will open for that new quarter VAT filing.

Details of Taxable Person

In the above section, details such as the “TRN” or “Tax Registration Number” of the taxpayer, as well as their name and address will be automatically filled.

In case of tax agent submitting the VAT return on behalf of a taxpayer, the details of TAAN (Tax Agent Approval Number) and the associated TAN (Tax Agency Number) along with the Tax Agent and the Tax Agency name are populated at the top of the VAT Return.

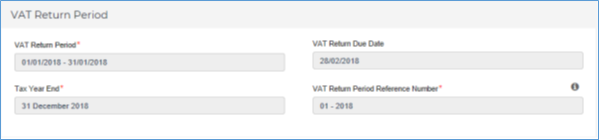

VAT Return Period

The details in the above section such as VAT return period for which you are currently filing a return, the Tax Year end, VAT return period reference number and VAT return due date will be auto-populated.

The tax year end is important for businesses who are not able to recover all of their input VAT and need to perform an input tax apportionment annual adjustment. Such adjustment is allowed only in the first return following the tax year end. VAT return period reference number indicates the VAT return period which you will be completing within that tax year.

If the VAT return period reference is 1, those affected businesses should include their input tax apportionment annual adjustment in that VAT return. Businesses need not worry now, because this is applicable after 1st year of VAT return i.e. from 1st January, 2019 onwards.

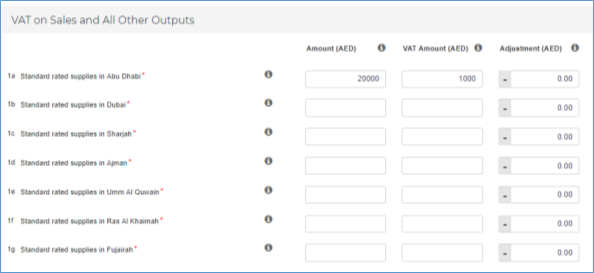

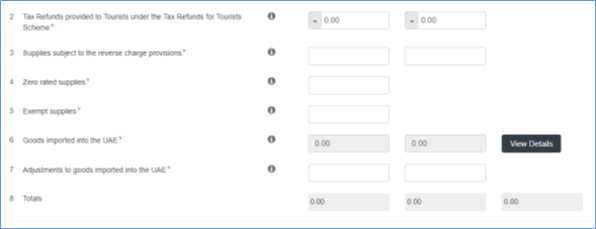

VAT on sales and all other outputs

In the above section, you need to furnish the details of standard rate taxable supplies at the Emirates level, zero rate supplies, exempt supplies, supplies subject to reverse charge mechanism etc.

VAT on Expenses and All other Inputs

In the above section, you need to furnish the details of purchases or expenses on which you have paid VAT at a standard rate of 5% and supplies subject to reverse charge basis along with the eligible recoverable input tax.

Net VAT Due

Output Tax

This section indicates your VAT payable for the VAT return period. The box number 12: Total Value of due tax for the period indicates the total value of output tax that is due for the Tax Period.

This will be calculated based on the information declared in Sales and all other outputs. This will be the sum of the Output VAT and Adjustments columns in the Sales and all other outputs.

Input Tax

Similarly, box number 13: Total value of recoverable tax for the period indicates total value of Input Tax that is recoverable for the Tax Period.

This will be calculated based on the details furnished in VAT expenses and all other inputs section. The box number 14 indicates the payable tax for the period. This will be the difference between the total tax due for the period and the total recoverable tax for the period. Either it will result in net VAT payable or recoverable tax.

If the amount in Box 12 is more than the amount in Box 13, the difference is the amount of VAT that you must pay. If the amount in Box 12 is less than the figure in Box 13, then you will be eligible to request a refund for the net amount of recoverable tax or carry it forward to the subsequent VAT return period.

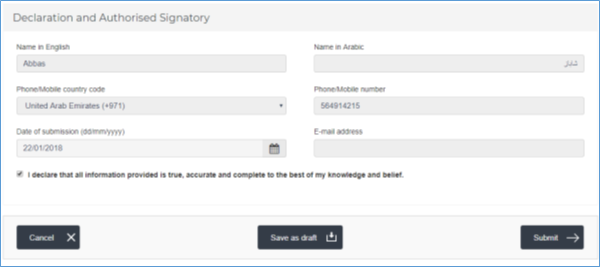

Declaration and Authorized Signatory

In the above section, provide the authorized signatory details and tick the box next to the declaration section to submit the VAT Return. The taxpayer also has an option to save the details as a draft and submit it later.

Before filing the VAT Return, the taxpayers have to take extreme care in verifying all the details of VAT and must ensure that all the information is correct, click the submit button. After the successful filing of the VAT Return, a taxpayer will receive an e-mail from FTA confirming the submission of VAT return form.

VAT Return Filing in Dubai, UAE

How to file a VAT return in UAE is a lengthy and complicated procedure. Businesses must take an expert opinion before submitting a VAT return as the errors in VAT filing will attract huge VAT fines and penalties from the Federal Tax Authority (FTA). Xact Auditing is one of the best audit and accounting firm in Dubai providing FTA compliant VAT Return Filing Services in Dubai.

Xact Services

Previous Post

Previous Post Next Post

Next Post